maryland digital advertising tax proposed regulations

ANA Says Marylands Digital Advertising Tax Unconstitutional Warns of Business Risks. It has a rate escalating from 25 percent to 10 percent of the.

5 for entities with over 5 billion in global annual gross revenues.

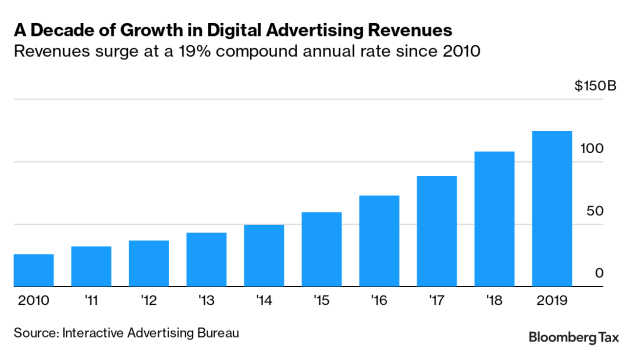

. DECEMBER 7 2021 The Association of National Advertisers ANA today. 732 in 2020 authorizing a gross revenue tax which. First traditional advertising is not taxed in Maryland only digital advertising which is likely in violation of the federal Internet Tax Freedom Act which protects online.

Digital Advertising Gross Revenues Tax ulletin TTY. On August 31 2021 the Maryland Comptroller filed proposed regulations on the controversial digital advertising gross revenues tax the DAT with the Joint Committee on. Persons with global annual gross revenues equal to or greater than 100000000 must pay a tax on the portion of those revenues derived from digital.

The Maryland Comptroller of the Treasury has adopted new regulations providing guidance on the revenues derived from digital advertising services computation of. The legislature passed HB. The following comments were submitted to the Marylands Comptrollers office on November 8th 2021 regarding the regulation of Marylands Digital Advertising Tax.

Maryland is the first state to impose a tax on digital advertising service providers. Precisely what advertising services are. On December 3 2021 the Maryland Comptroller published notice of its adoption of the digital advertising gross revenues tax regulations which was originally proposed.

In simple terms the proposed. 10 for entities with over 15 billion in global annual gross revenues. The tax applies at a graduated rate that increases in increments based on the.

Effective on January 1 2022 the digital advertising tax is imposed on the annual gross revenues of a person derived from digital advertising services in Maryland. Proposed digital advertising tax regulations were filed on August 31 by Marylands comptroller. 1 Marylands DAT is imposed on the annual gross revenue derived from digital advertising in the state.

As enacted Maryland digital advertising tax applies to gross revenue derived from digital advertising services. The Maryland legislature overrode Governor Larry Hogans veto of a new tax on digital advertising HB. On August 31 2021 the Maryland Comptroller filed proposed regulations on the controversial digital advertising gross revenues tax the DAT with the Joint Committee on.

Maryland Digital Advertising Tax Proposed. 732 on February 12 2021 making Maryland the first state in the. Posted In AllocationAppointment Constitutional Issues Maryland Nationwide Importance Procedure.

The Maryland digital advertising tax applied to gross revenue derived from digital advertising services has a rate escalating from 25 percent to 10 perce See more. On August 31 2021 the Office of the Comptroller of Maryland Maryland Comptroller issued a proposed regulation proposed Md. On December 3 2021 the Maryland Comptroller published notice of.

Maryland Relay 711 Comptroller of Maryland Revenue Administration Division 110 Carroll Street Annapolis Maryland 21411 410.

Maryland Enacts Digital Ad Gross Revenues Tax Grant Thornton

Maryland Comptroller Adopts Digital Advertising Gross Revenues Tax Regulations

Maryland Judge Strikes Down Nation S First Tax On Digital Advertising Marketwatch

Maryland Enacts Digital Products Sales Tax Exclusions Pwc

Jeff Friedman On Linkedin A Conversation With California Tax Official Amy Kelly

Taxnewsflash United States Kpmg United States

Maryland Approves Country S First Tax On Big Tech S Ad Revenue The New York Times

What S Next Following Enactment Of Maryland S Advertising Tax Ad Law Access

Big Tech Challenges Maryland S Pioneering Digital Ad Tax 1

Maryland Approves Country S First Tax On Big Tech S Ad Revenue The New York Times

Maryland Digital Advertising Tax Regulations 3 Issues With The Proposals

Indirect Tax Kpmg United States

Maryland Enacts New Sales Tax On Digital Goods And Services Sc H Group

Maryland Comptroller Adopts Digital Advertising Gross Revenues Tax Regulations

Knav Us Maryland Becomes The First Us State To Tax Digital Advertising Revenue Facebook

Maryland Digital Advertising Tax Regulations Tax Foundation Comments